How Managers Can Help Build Core Teams, Check Attrition

A team that stays together, grows together. A team that stays together, and is also led by a visionary manager, propels an organisation to newer heights — year after year. This is one lesson that the BFSI sector in India, perhaps, needs to internalise.

Leading private Indian banks have attrition rates of more than 30%

The BFSI space in India may be oozing confidence, but it’s also true that the sector is saddled with a huge problem (some would call it an existential problem, especially at entry levels). The attrition rate in private banks today is unusually high, with leading private banks reporting a turnover of over 30 per cent in FY23. The figure shoots up further to over 40 per cent at entry and junior levels. With around 35 per cent of attrition rate, frontline sales employee turnover rate in many private banks hovers around over the 55 per cent mark.

Industry experts say that many frontline roles, including housing loan sales and credit card sales, face particularly worrying rates of employee turnover.

It’s argued that employees, especially the younger lot, find “mushrooming opportunities” in NBFCs and the fintech sector “too attractive to resist”, and hence switch organisations frequently. New technologies, digitisation, competing salaries offered by other industries, and Gen Next aspirations are among other oft-quoted reasons for the unusually high attrition rates in private banks at junior levels. Industry experts also point to “lack of on-job training” and “poaching” as contributory factors.

But, this larger trend doesn’t augur well for the health of private banks and the BFSI space at all.

The phenomenon has caught the attention of no less than the RBI Governor himself. At a recent event, Governor Shaktikanta Das expressed concern over high attrition rates in private banks. He said there was a need to create and nurture “core teams” to address the problem. While the Governor was definitely concerned over high attrition rates in certain private banks, he stressed that the RBI had not suggested any measures to check the trend. Instead, the Governor added, it was up to the banks to deliberate upon the trend and create “core teams”, that would go on to create robust organisations reflecting healthier organisational cultures.

Training managers to build core teams

With a good Manager, a good team is created. Together they help build a great organisation. Instead of being guided more by short-term imperatives, such organisations then think long-term. There are many ways in which managers can create “core teams” and then nurture them towards long-term organisational goals. The ones who successfully steer such teams come to be regarded as “Effective People Managers” who go on to build iconic organisations.

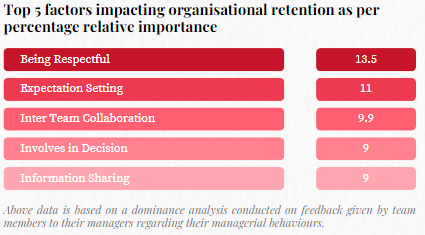

Research conducted by the Great Manager Institute® highlighted several managerial characteristics that contribute to employee retention within an organization, particularly when managers exhibit these traits. The top five traits impacting organisational retention scores identified in the study were: “being respectful” at 13.5%; “expectation setting” at 11%; “inter-team collaboration” at 9.9%; “involvement in decisions” at 9% and “information sharing” at 7.9%.

These also constitute the basic traits of “Effective Managers”. Managers with characteristics identified above can go a long way in creating, retaining and nurturing “core teams” – something that will help private banks and the larger BFSI sector to aspire for big goals and grow consistently.

The role of managers in building core teams for India’s BFSI Sector

Maybe, then, it’s time the Manager stepped up his or her game. Maybe it’s time the banks asked the Managers to think long-term and work towards developing long-term in-house resources. Maybe it’s time Managers stressed building “core teams”.

A team that stays together, and is led by a hands-on Manager, leads to a purposeful organisation. Trust and stability, growth and prosperity, become buzzwords in such orgnaisations. Maybe the Managers at India’s leading private banks need to get back to drawing boards and work on blueprints where team building is top priority.

Many experts in organisational behavior and HR consultants who followed the unusually high attrition rates during the “The Great Resignation” in the wake of the Covid-19 pandemic came up with useful insights — which are relevant for India’s BFSI sector in the current context as well.

A 2021 Harvard Business Review paper by Ron Carucci “To retain employees, give them a sense of purpose and community” cited a McKinsey research report and said that the top two reasons why employees tend to leave were: 1) “they feel their work is not valued enough by the organisation (54 per cent)”; 2) “they lack a sense of belonging at work (51 per cent)”.

Carucci then advocated for “enhancing solidarity through ownership of policy”, and said that “instead of making career and professional development a separate experience,” there was a need to “build learning and advancement right into people’s roles”.

These policy prescriptions are, perhaps, relevant to India’s BFSI sector, too. Here, the Manager is uniquely placed to usher change, with building “core teams” as the first and most important starting point.

Managers must groom young teams into long term valuable resources

A June 2023 paper by Anand Chopra-McGowan in the Harvard Business Review talked about “5 ways companies are addressing skills gaps in their workforce”. The paper’s takeaways are significant for India’s BFSI Sector, too.

The paper talks about “the new digital apprenticeship”, “a fresh approach to tuition reimbursement”, “a shift to learning experience platforms”, “the democratisation of coaching”, and the rise of “cohort-based courses” as the new approaches to the companies are adopting to constantly upskill their workforce.

The learning and takeaway for the Indian BFSI sector? Traineeship or apprenticeship may be a great way to initiate a young talent into the organisation. It’s for the manager then to groom – and retain – the young team into a long-term valuable resource, over a period of time.

The Harvard paper talks about the “Learning Management Systems” being replaced by “Learning Experience Platforms”. Maybe, the BFSI managers can also toy with “experiential learning systems” for team members.

Good news - The average BFSI manager in India is rated highly by peers and team members.

To address the systemic ills being faced by the BFSI sector, and to build “core teams” as a long-term response to set things right, the community of managers in the BFSI sector will, thus, be keenly watched. What is reassuring, however, is that the average BFSI manager in India is rated highly by peers and team members. He or she has only to shift gears now. A survey carried out by the Great Managers Institute® found out that “56 per cent of the managers (in the sector) were perceived to be competent,” and that only “12.98 per cent of the managers were found to be inconsistent in 10 or more than 10 out of the total 21 behavioural traits studied”

The BFSI sector in India is today valued at over Rs 81 trillion. And, India is among the fastest growing fin-tech markets. If India has to keep up the momentum, private sector banks will have to lead from the front. The reset exercise, however, must necessarily begin with the Manager. It’s the Manager who will help build a “core team”. Together, they will help build a robust, stable organisation. Many such organisations, together, will help India’s BFSI sector live up to its true potential.