India is among the fastest growing fin-tech markets in the world today. This is one of many indicators often cited to point to “a robust BFSI sector in the country”. It is also argued, to cite another oft-quoted example, that “the banks are not saddled with stressed balance-sheets any longer”. The buzzing BFSI sector in India is today valued at over Rs 81 trillion.

Does that mean that all is well with the BFSI sector in the country?

Does a “golden future” really await the sector?

Experts would, perhaps, call for a caveat or two. They would argue, for instance, how private sector banks have a high attrition rate, especially at junior levels. To cite another example, the need for newer skills – and the need for their continuous upgradation – poses a constant challenge for managers and CEOs alike.

So, if India’s BFSI sector has to script a “golden future,” (the fin-tech industry should grow to $ 1 trillion by 2030, according to one estimate), its managers must lead from the front, they must lead by example, they must also be adept at “de-learning’ and “re-learning” — especially in the age of AI and disruptive technologies.

For the economy to grow at a healthy pace, corporates and businesses have a key role to play. To enable corporates to perform at their optimal, the managers must perform outstandingly (and consistently). Whether it’s about retaining teams or achieving targets, helping teams ace new skills, or the ability to stay ahead of the competition, promoters and employees alike look up to the managers. The Great Indian Manager, thus, must rise to the occasion.

Revamping Skills for the AI and Industry 4.0 Era

In the age of Industry 4.0, disruptive technologies, and AI, the skillsets undergo quick overhauls and upgrades.

The managers should always be on their toes and should have the ability to think on their feet. This is particularly true for India’s BFSI sector.

The sector needs its personnel to be masters in technology, regulatory expertise, risk management, financial expertise, and analytical skills — in addition to communications and interpersonal skills. A couple of years ago, a report made the case for the evolving skill sets and skilled employees in the BFSI sector.

The report, “Insight on BFSI sector: Skill gap report and in-demand job roles in BFSI sector” by the BFSI Sector Skill Council of India, outlined how the BFSI skill sets had changed or evolved in the age of AI, Blockchain, and disruptive technologies.

For “Banking,” the report argued that communications and interpersonal skills, people management skills, knowledge of products and benefits, financial modeling, tech know-how, and regulatory/legal knowledge would be much in demand.

For insurance, in addition to the soft skills, financial acumen, data structures and algorithms, problem-solving skills, and domain expertise would be valued, said the report. For fin-tech, apart from soft skills (common to all BFSI verticals), and domain expertise, quantitative skills, financial and accounting skills, and problem-solving skills would be prized, added the report.

The skill sets will continue to evolve for all times to come. If the sector has to far exceed the 7.74 percent rate of growth witnessed between 2012 and 2020, the managers will have to play a pivotal role — especially in helping colleagues keep pace with the evolving skillsets.

This is, however, easier said than done. It may not be easy, for instance, to allow many employees for “regular sabbaticals” for the upgradation of their skills. Online courses, on the other hand, may only have a limited role.

Behavioral traits of a great manager in the BFSI industry

A study by the Great Manager Institute® on how different managerial behaviours are rated, and how such behaviours help a manager become an “effective people manager”, offers important insights.

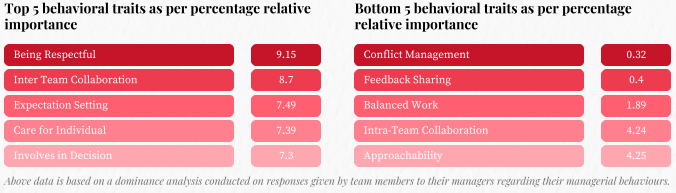

Among 18 common behavioural traits identified in the survey, the top five are — “being respectful”, “inter-team collaboration”, “expectation setting”, “care for individual” and the “tendency to involve colleagues in decision making”. Managers who exhibit these traits in abundance are considered “effective people managers” by team members and peers.

Leadership development and managerial capability development initiatives conducted by companies in the BFSI industry should focus more on the top 5 behavioral traits to enable their managers to become more effective.

Managers must groom young teams into long term valuable resources

A June 2023 paper by Anand Chopra-McGowan in the Harvard Business Review talked about “5 ways companies are addressing skills gaps in their workforce”. The paper’s takeaways are significant for India’s BFSI Sector, too.

The paper talks about “the new digital apprenticeship”, “a fresh approach to tuition reimbursement”, “a shift to learning experience platforms”, “the democratisation of coaching”, and the rise of “cohort-based courses” as the new approaches to the companies are adopting to constantly upskill their workforce.

The learning and takeaway for the Indian BFSI sector? Traineeship or apprenticeship may be a great way to initiate a young talent into the organisation. It’s for the manager then to groom – and retain – the young team into a long-term valuable resource, over a period of time.

The Harvard paper talks about the “Learning Management Systems” being replaced by “Learning Experience Platforms”. Maybe, the BFSI managers can also toy with “experiential learning systems” for team members.

Undoubtedly, it’s the great people managers who will help India’s BFSI sector bridge the talent gap.

When they work in tandem with L&D teams, a mechanism to study, survey, and identify the skill-sets needed, and expected to be required in the future, can become an integral part of the organisation’s culture. An agile organisation always tries to be ahead of time.

The Indian BFSI sector has come a long way in the last decade or so. Consider for instance how digital payments have revolutionised the sector. Consider, to cite another example, how India, today, has the world’s fourth-largest bank.

The task for the Indian BFSI managers, however, should not overwhelm them. To be sure, most of the managers of the sector are perceived to be competent and rated highly by peers. In a study by the Great Manager Institute® only “12.98 percent of the managers were found to be inconsistent in 10 or more than 10 of the total 21 behavioural traits studies”, while “56 percent of the managers were perceived to be competent”.

Tech and IT leaders never talk “long-term” For, the pace at which technology is evolving is mind-boggling. Consider for instance the impact that AI has had on economies and businesses.

For a tech-driven sector like BFSI, then, to project future projections is not without risks. It’s precisely for this reason why the manager’s role will become all the more important in steering change, in ensuring stability, and in delivering results. The Indian BFSI sector is destined to register impressive growth. The new skill-sets will be key to the future targets. It’s the Great Indian Manager who will ensure that whether it’s reskilling or upgrading, de-learning or relearning, the BFSI sector lives up to its inherent potential.